Understanding the Historical past of Receipt Requirement

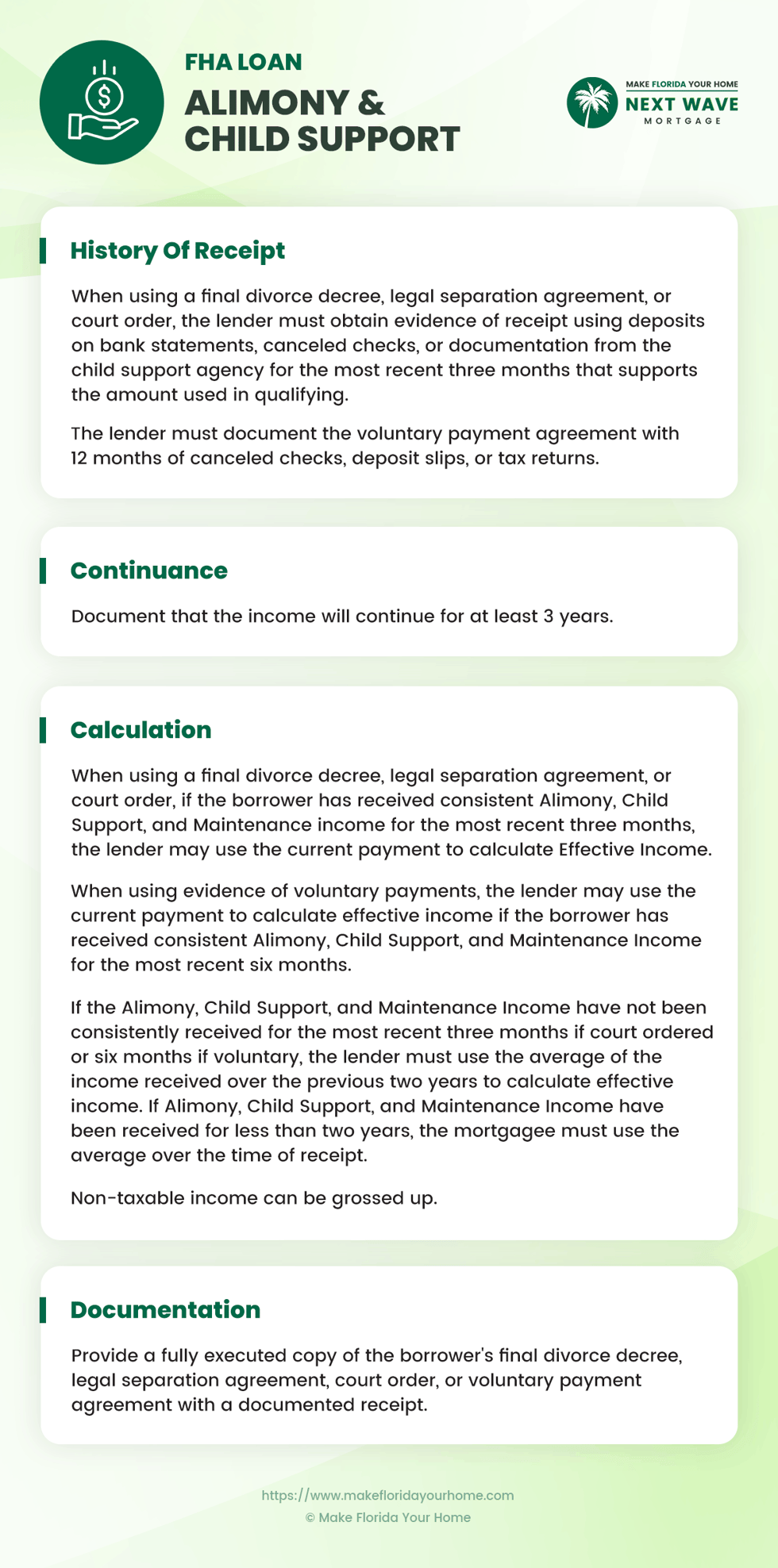

If you apply for an FHA mortgage and get more money from alimony or little one help, the lender will need to see that you’ve got been getting this cash frequently for some time. That is what they name ‘Historical past of Receipt.’

They don’t seem to be simply curious; they should guarantee this cash is a steady a part of your earnings to allow them to belief it’s going to assist you pay for your own home in the long term.

The ‘Historical past of Receipt’ is sort of a monitor report. It reveals the lender that the additional cash you get from alimony or little one help has been coming in steadily. Consider it as your monetary attendance report.

Similar to attendance report in school or work can present you are dependable, historical past of receipt reveals lenders which you can depend on this cash to maintain coming in. They often need to see that it has been taking place for at the very least three months.

So what counts as proof? Lenders often search for paperwork that present the cash has been deposited into your checking account or handed to you.

Listed here are some examples:

-

Financial institution Statements: These present the cash coming into your account frequently. It is like a snapshot of your monetary comings and goings.

-

Canceled Checks: For those who get checks, exhibiting ones which were cashed proves you bought the cash.

-

Deposit Slips: For those who deposit checks or money, these slips from the financial institution might be proof, too.

- Tax Returns: For those who report this earnings in your taxes, your returns also can function proof.

How To Set up Continuance of Revenue

After you have proven that you’ve got a strong historical past of receiving alimony or little one help, the subsequent step is to show that this cash will maintain coming sooner or later.

That is what lenders name ‘continuance’. They need to ensure that the help funds you are getting now will proceed for at the very least three extra years.

It is because FHA loans are for individuals who will keep of their properties for some time, and lenders must know you may have the funds to make your funds down the street.

You will often want authorized papers that say how lengthy you are purported to obtain these funds to point out that your alimony or little one help will proceed.

For instance, a divorce decree or a authorized settlement may state that you’re going to get little one help till your little one turns 18. That is a authorized fee promise you may present your lender.

However what if the paperwork would not say how lengthy the funds will final? Or what if it is a verbal settlement with out official papers?

It’s kind of more durable in these instances, however you may nonetheless work together with your lender. You may want to point out a historical past of funds over an extended interval or present letters from authorized consultants who perceive your scenario.

Now, whereas authorized paperwork are tremendous vital, they are not the one factor lenders have a look at. They’re additionally going to think about the age of your youngsters.

In case your children are younger and also you’re receiving little one help, the lender can guess that these funds will proceed for a few years. But when your children are older, the lender may ask how probably the funds will proceed for the required three years.

For those who’re receiving alimony, the lender may have a look at issues like how lengthy you had been married and whether or not the alimony is supposed that can assist you get again in your ft for a short while or help you over a long term.

They could additionally have a look at whether or not you are working or have the potential to earn an earnings that might exchange the alimony sooner or later.

Right here’s a professional tip: at all times maintain your authorized paperwork up to date. If there is a change in your alimony or little one help, get it in writing.

For those who’ve obtained funds with none hiccups and one thing adjustments as the quantity goes up or down, guarantee that is documented legally. Lenders like to see that you just’re up to the mark and have a authorized framework to make sure the funds proceed.

By proving the continuity of your earnings from alimony or little one help, you guarantee the lender that you are a protected wager. You are exhibiting that not solely do you could have monitor report, however you are additionally set to obtain this earnings for a protracted sufficient time to cowl the lifespan of the mortgage.

Like with the historical past of receipt, the stronger your proof of continuance, the higher your probabilities of getting your FHA mortgage accredited. So collect these paperwork and proceed your journey to a brand new dwelling.

Calculating Your Efficient Revenue

As soon as you have sorted out your historical past and continuance of earnings, the subsequent factor your lender will need to determine is your ‘efficient earnings.’

That is how a lot you will need to pay in your month-to-month payments and your FHA mortgage. For lenders, it isn’t nearly how a lot you get however how a lot you may reliably use in your mortgage.

Now, how do they calculate this? In case your funds are regular and the identical quantity every time, the lender will merely add up what you have obtained over the previous couple of months or years.

For example, should you’ve acquired $500 month-to-month from little one help, and it has been that means for some time, they will depend that as a part of your efficient earnings.

This is a easy step-by-step information on the way to do it:

Collect Your Fee Info

Gather all of your alimony or little one help fee data. This may very well be financial institution statements, fee stubs, or court docket paperwork that present how a lot you obtain and when.

Checklist Your Month-to-month Quantities

Write down the cash you obtained every month. If the quantity adjustments, be aware every variation.

Add and Common

In case your funds are constant, add the month-to-month quantities. For instance, should you obtain $500 a month, and you’ve got obtained it for six months, that is $500 x 6 = $3000.

Nevertheless, if the quantities range, add the full obtained over the interval you are measuring, then divide by the variety of months.

For example, if over six months you obtained a complete of $3200, you’d calculate $3200 / 6 = about $533 per thirty days.

Alter for Non-taxable Revenue

You’ll be able to’ gross it up in case your alimony or little one help is non-taxable.’ This implies you enhance the quantity by a sure share (your lender will let you know the share, typically 15-25%).

So, in case your month-to-month common is $533 and you’ll gross it up by 25%, you’d calculate $533 x 1.25 = about $666.

Doc Your Calculation

Write your calculations and the ultimate month-to-month efficient earnings determine. Hold this together with your monetary data to share it together with your lender.

By rigorously following these steps, you may decide your efficient earnings from alimony or little one help. Bear in mind, this determine helps lenders perceive your monetary scenario higher and might enhance your probabilities of qualifying for an FHA mortgage.

For those who’re uncertain in regards to the calculations or the paperwork you want, do not hesitate to ask a mortgage officer for steering.

One other a part of the puzzle is ‘non-taxable earnings.’ Some cash, like sure forms of little one help, is not taxed. It counts extra in direction of your mortgage utility as a result of you may maintain all of it.

This is the place it will get a bit extra technical – lenders ‘gross up’ this earnings. Which means they enhance the quantity for the mortgage utility to replicate that it isn’t taxed.

In case your lender ‘grosses up’ your non-taxable earnings by 25%, then for each $100 you get, they act like you could have $125 for paying your mortgage.

Consistency in your funds is tremendous vital in your efficient earnings. Lenders see that as signal should you’ve acquired the identical quantity coming in month after month, 12 months after 12 months.

It tells them you have acquired a dependable stream of cash as reliable as a paycheck. That is why they have a look at your historical past – to see how regular your alimony and little one help funds are.

The Documentation You Have to Get Accepted for an FHA Mortgage

Getting an FHA mortgage means exhibiting the lender a transparent image of your funds. This contains how a lot you make and the place your cash comes from.

If a part of your earnings is alimony or little one help, you will need to show it. This is what you must collect:

Guidelines of Required Paperwork

-

Authorized Paperwork: These are papers like your divorce decree, which reveals you are purported to get alimony or little one help. They spell out the main points: how a lot, how typically, and for the way lengthy you may get the cash.

-

Fee Information: Financial institution statements or deposit slips can show you have obtained these funds. For those who’re paid by verify, maintain the canceled ones or get copies out of your financial institution.

-

Tax Returns: For those who declare alimony or little one help in your taxes, your returns can again up your declare.

-

Court docket or Company Receipts: Typically, funds are tracked by a court docket or company. Receipts from them are strong proof.

- Letter from the Payer: If funds are casual, a letter from the particular person paying may assist. It ought to say how a lot they pay and that they’re going to maintain doing it.

Understanding the Documentation

The paperwork you accumulate aren’t simply paper; they inform a narrative. They present your lender you are good for the mortgage as a result of you could have a gentle, dependable earnings.

Every doc performs a component:

-

Authorized paperwork set the stage, exhibiting the phrases agreed upon.

-

Fee data are the day-to-day script, proving you are getting the cash as agreed.

-

Tax returns are just like the annual opinions, exhibiting the earnings is acknowledged formally.

-

Court docket or company receipts are third-party confirmations, including credibility.

- A payer’s letter is a private promise, giving a face to the dedication.

Widespread Pitfalls to Keep away from

When gathering your paperwork, be careful for these errors:

-

Previous Info: Outdated paperwork will not replicate your present scenario. All the time use the newest data.

-

Incomplete Information: Lacking a month or two? That may very well be an issue. Lenders need the complete image with out gaps.

-

Assuming Verbal Agreements Rely: If it isn’t in writing, it is arduous to show. Get every thing documented.

-

Forgetting to Gross Up: Non-taxable earnings might be counted for extra, however it’s important to present it correctly.

- Not Checking for Errors: All the time look over your paperwork. Errors can journey you up.

Following these steps and avoiding widespread errors builds a robust case in your FHA mortgage approval. Bear in mind, the higher your documentation, the smoother your journey to homeownership shall be.

FAQ’s About Getting an FHA Mortgage With Alimony and Baby Help

As you navigate making use of for an FHA mortgage with alimony and little one help earnings, you could have particular questions on distinctive circumstances or how sure adjustments in your life may have an effect on your utility.

Under are ten regularly requested questions with concise solutions to assist information you thru these issues.

Can I qualify for an FHA mortgage if my alimony or little one help is because of finish in lower than three years?

Qualification could also be difficult in case your help funds are set to finish inside three years as lenders search for earnings stability. Nevertheless, different sources of earnings or a co-borrower may assist strengthen your utility.

What occurs if my alimony or little one help funds lower after I have been accredited for an FHA mortgage?

In case your earnings decreases considerably, you will need to notify your lender instantly. They could reassess your monetary scenario to make sure you can nonetheless afford the mortgage funds.

Can I re-apply for an FHA mortgage if I have been denied beforehand attributable to inadequate alimony or little one help documentation?

Sure, you may re-apply for an FHA mortgage. Guarantee you could have collected extra sturdy documentation to exhibit the consistency and continuance of your alimony or little one help earnings.

How does a change in custody have an effect on my eligibility for an FHA mortgage if I am receiving little one help?

A change in custody might have an effect on your FHA mortgage eligibility if it considerably alters your little one help earnings. It’s best to inform your lender of any adjustments and supply up to date documentation.

If I remarry, will my alimony nonetheless be thought of earnings for an FHA mortgage?

Alimony should be thought of earnings for an FHA mortgage after remarriage, however this relies on the phrases of your divorce decree or settlement. It is vital to evaluate the phrases and seek the advice of together with your lender.

Are there any particular issues for self-employed people receiving alimony or little one help when making use of for an FHA mortgage?

Self-employed people should present extra documentation to show their earnings stability, together with alimony or little one help. This may occasionally embody tax returns and enterprise monetary statements.

What ought to I do if I obtain alimony or little one help funds in money? How can I doc this for an FHA mortgage utility?

Hold detailed data of every transaction for money funds, together with dates and quantities. A signed receipt from the payer for every fee also can function documentation.

Can overdue alimony or little one help funds be included as efficient earnings as soon as paid?

Overdue funds might be included as a part of your efficient earnings, however you may must show that these funds had been obtained and are more likely to proceed persistently.

If my alimony or little one help payer has an inconsistent fee historical past, how can I strengthen my FHA mortgage utility?

Present as a lot documentation as potential to point out the historical past of funds. A letter of rationalization and any authorized steps to safe constant funds also can assist.

Are there any implications for my FHA mortgage if I pay and obtain alimony or little one help?

The web quantity shall be thought of should you’re each paying and receiving help. You will must doc each the earnings and the obligations to supply a transparent image of your internet efficient earnings.

The Backside Line

Navigating the FHA mortgage course of with alimony and little one help earnings might be advanced, however it’s completely manageable with the fitting preparation and understanding.

The important thing lies in meticulously documenting your earnings, staying knowledgeable about how completely different eventualities can influence your utility, and speaking overtly together with your lender.

Bear in mind, every bit of documentation you present helps paint a clearer image of your monetary stability, making it simpler for lenders to evaluate your mortgage eligibility.

Whether or not you are simply beginning out on this journey or are revisiting the method with new circumstances, remember that the aim isn’t just to qualify for the mortgage however to make sure it is a sustainable monetary determination in your future.

With this information in hand, you are outfitted with the data to navigate the FHA mortgage utility course of confidently, transferring one step nearer to securing a house that fits your wants and your monetary scenario.