This distinctive facet permits sellers or builders to contribute as much as 4% of the sale worth in direction of the customer’s prices, together with presents like home equipment, paying off credit score balances, and even judgments. Nonetheless, this 4% doesn’t embody closing prices, that are calculated individually.

To maximise their advantages whereas sustaining compliance, veterans should perceive these concessions.

On this information, we are going to discover Vendor/Builder concessions in-depth, serving to veterans higher perceive their VA mortgage advantages.

What Are Vendor/Builder Concessions in VA Loans?

Vendor/Builder concessions confer with the follow the place sellers or builders contribute in direction of the customer’s prices in a VA mortgage transaction.

This could embody numerous prices similar to home equipment, payoff of credit score balances, or judgments, enhancing the attractiveness of VA loans for veterans. The concessions are capped at 4% of the mortgage quantity, decided by the VA’s closing Discover of Worth (NOV).

This 4% restrict is calculated independently of the customer’s closing prices, particularly allotted for extra advantages exterior commonplace mortgage closing bills.

This provision goals to offer monetary reduction to veteran patrons, permitting them to allocate funds extra freely in direction of different elements of their residence buy.

What Counts In the direction of the 4% Restrict?

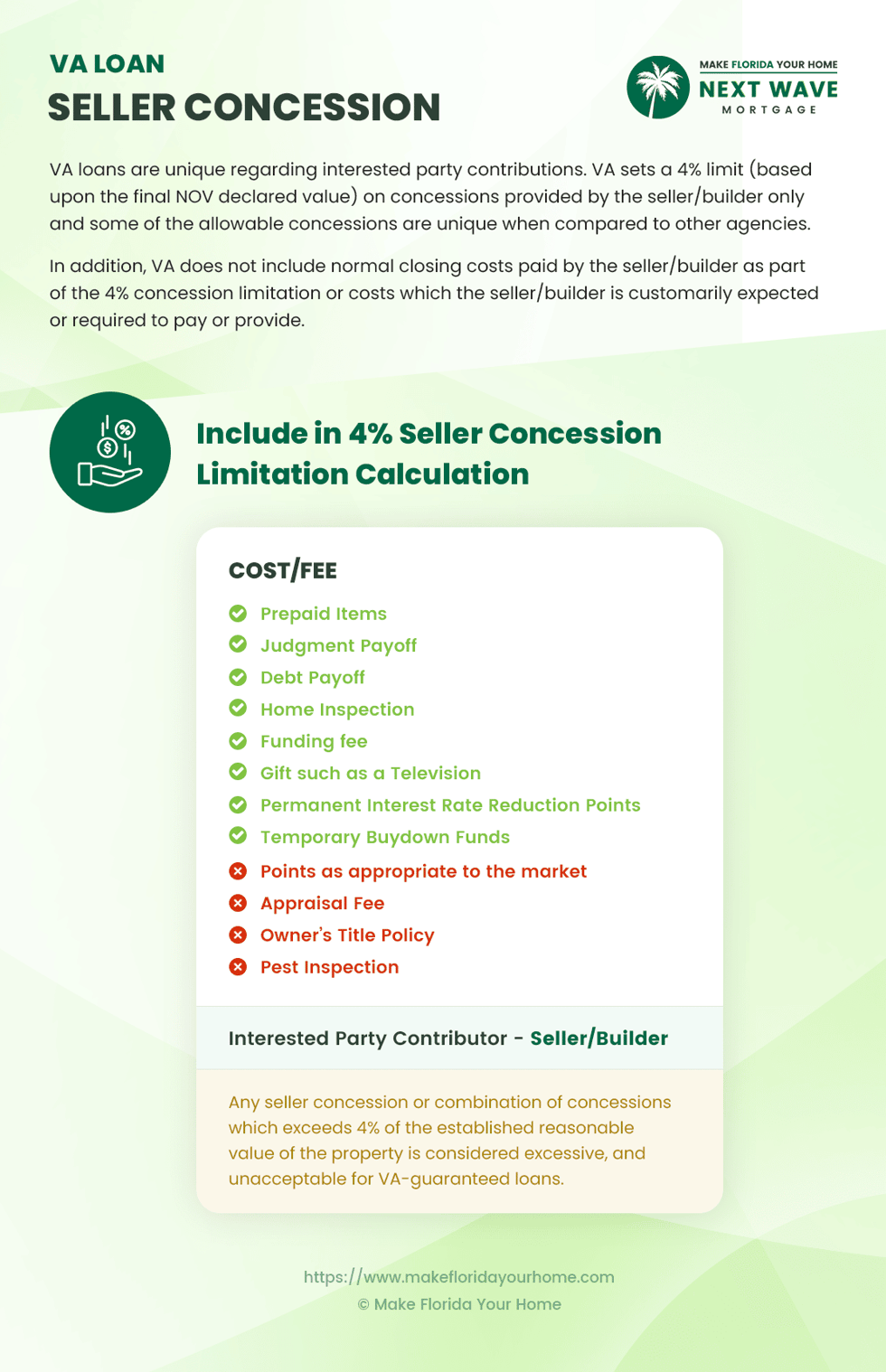

VA loans’ 4% concession restrict encompasses particular prices and charges that instantly profit the customer however are exterior the same old scope of closing prices.

This restrict contains however shouldn’t be restricted to objects like funding charges, pay as you go objects, and fee in direction of the customer’s money owed to facilitate the acquisition.

Distinctive to VA loans, these concessions also can cowl private property objects given to the customer, similar to home equipment or furnishings.

In distinction to conventional loans, VA loans provide a broader choice of concessions, giving veterans better flexibility and monetary help throughout home-buying.

How Vendor Concessions Assist Your Household: Case Research and Examples

Let’s discover real-world eventualities to really admire the flexibleness and advantages of Vendor/Builder concessions in VA loans.

These case research illustrate how concessions could be utilized in sensible conditions, providing important benefits to veterans in residence shopping for.

From enhancing residence worth with upgrades to enhancing monetary well being by paying off debt, the next examples display the tangible influence concessions can have on mortgage phrases and purchaser advantages.

Equipment Improve State of affairs

A veteran shopping for a house is obtainable a $6,000 equipment improve package deal by the vendor as a part of the concession.

This enhances the house’s worth and saves the veteran from out-of-pocket bills for important home equipment, illustrating how concessions could be tailor-made to satisfy the customer’s instant wants.

Debt Consolidation Instance

One other case includes a vendor agreeing to make use of concessions to repay $5,000 of the customer’s bank card debt.

This strategic use of concessions lowers the customer’s debt-to-income ratio, probably qualifying them for a greater mortgage charge and demonstrating the flexibleness of concessions to enhance monetary stability for the customer.

Closing Prices and Pay as you go Mixture

In a special situation, concessions cowl the customer’s closing prices and prepay property taxes and insurance coverage for the primary yr.

This complete help considerably reduces the preliminary monetary burden on the veteran, showcasing how concessions can cowl a variety of bills past the instant sale.

Eligibility Standards for Vendor/Builder Concessions

To qualify for Vendor/Builder concessions within the context of VA loans, each patrons and sellers should adhere to particular pointers and necessities set forth by the Division of Veterans Affairs.

For veterans (patrons) to be eligible, they have to:

-

Be eligible for VA mortgage advantages: This usually means they’ve served within the armed forces for a particular interval, as outlined by the VA.

-

Acquire a Certificates of Eligibility (COE): This certificates proves the veteran’s entitlement to VA mortgage advantages.

- Meet credit score and earnings necessities: Though VA loans are recognized for his or her flexibility, veterans should nonetheless meet sure credit score scores and earnings thresholds to qualify for a mortgage.

Sellers or builders taking part in this system should additionally perceive the VA’s pointers, together with:

-

Concessions restrict: The entire worth of concessions the vendor or builder affords can’t exceed 4% of the mortgage quantity. That is along with another closing prices the vendor agrees to pay.

-

Kind of concessions allowed: The VA specifies what could be included. These can vary from paying off the customer’s money owed, offering home equipment, or overlaying pay as you go bills.

- Compliance with VA appraisal: The property should meet or exceed the appraised worth decided by a VA-certified appraiser, making certain the mortgage quantity doesn’t exceed the house’s worth.

A clean and compliant transaction is determined by each events understanding these standards. Veterans focused on utilizing VA loans ought to seek the advice of a VA-approved lender like MakeFloridaYourHome to debate their scenario and eligibility.

Comparability with Standard Mortgage Concessions

Vendor/Builder concessions play a big position in residence shopping for, with distinct variations between VA and standard loans.

This is a comparative evaluation to assist veterans perceive these variations:

Concession limits

VA loans enable sellers to contribute as much as 4% of the mortgage quantity in direction of the customer’s prices, separate from closing prices.

Conversely, typical loans have various concession limits based mostly on the property’s down fee quantity and occupancy standing.

For instance, if a purchaser places down lower than 10%, the vendor’s concessions are usually restricted to three% of the acquisition worth.

Sorts of prices coated

VA mortgage concessions can cowl many prices, together with fee in direction of the customer’s money owed, home equipment, and different non-closing objects.

Standard loans are extra restrictive, with concessions normally restricted to closing prices, pay as you go objects, and, in some instances, low cost factors.

Flexibility for patrons

VA loans provide better flexibility relating to what the concessions can cowl, offering veterans with important monetary reduction and potential financial savings.

That is notably useful for veterans dealing with monetary constraints or looking for to attenuate out-of-pocket bills throughout home-buying.

Influence on mortgage approval

Giant vendor concessions can generally be seen negatively for typical loans, as they could inflate the sale worth and have an effect on the loan-to-value ratio (LTV).

With their particular cap and objective for concessions, VA loans are designed to help the veteran with out unduly influencing the mortgage approval course of.

In abstract, whereas each VA and standard loans provide mechanisms for sellers to help patrons, VA loans present a extra veteran-friendly framework.

This contains increased concession limits and broader utilization, providing veterans a singular benefit within the home-buying course of. Understanding these variations will help veterans make knowledgeable selections when evaluating mortgage choices.

How you can Negotiate Vendor/Builder Concessions: Ideas and Methods for Veterans

Navigating the negotiation course of for Vendor/Builder concessions in a VA mortgage can considerably influence the affordability and worth of your house buy.

Listed here are some ideas and methods for veterans to successfully negotiate concessions and customary pitfalls to keep away from.

Perceive the Worth of Concessions

It’s best to totally perceive how concessions from the vendor or builder can profit you earlier than coming into negotiations.

Concessions can cowl numerous prices, together with home equipment, closing prices, and even debt reimbursement. By prioritizing your negotiation factors, you will get what you want most.

Analysis the Market

Information of the present actual property market in your required space can present leverage in negotiations. If it is a purchaser’s market, you might have extra room to barter concessions since sellers is perhaps keen to shut the deal.

Conversely, in a vendor’s market, it’s possible you’ll have to be extra strategic in your requests.

Put together Your Funds

Having a transparent image of your monetary scenario and being pre-approved for a VA mortgage can strengthen your negotiating place.

Sellers usually tend to contemplate your requests significantly in the event that they see you as a dedicated and financially ready purchaser.

Spotlight the Advantages to the Vendor

When negotiating, it is useful to border concessions in a approach that additionally highlights advantages for the vendor. For instance, providing a quicker closing course of in trade for concessions could be enticing to sellers who’re desperate to promote.

Make the most of a Educated Actual Property Agent

An actual property agent skilled in VA loans could be invaluable throughout negotiations.

They’ll advise on what concessions to ask for, easy methods to body your requests, and easy methods to negotiate in your behalf, utilizing their market data and VA mortgage processes.

Be Keen to Compromise

Whereas asking for the required concessions is necessary, being versatile and keen to compromise can facilitate negotiations.

Take into account what you are keen to surrender or decrease your expectations on to succeed in an settlement that advantages each events.

Widespread Pitfalls to Keep away from

Overreaching

Asking for concessions that far exceed the 4% cap or are unrealistic, given the market situations, can bitter negotiations. Keep knowledgeable about what’s cheap to request.

Failing to Prioritize

Not all concessions are equally useful. Prioritize your requests based mostly on what may have essentially the most important influence in your monetary scenario and home-buying expertise.

Neglecting to Get Every thing in Writing

Verbal agreements are usually not binding. Guarantee all agreed-upon concessions are clearly documented within the buy settlement to keep away from misunderstandings later.

Overlooking the Appraisal

Keep in mind that the VA mortgage course of contains an appraisal. The house’s worth should help the acquisition worth plus any agreed-upon concessions. Guarantee your requests don’t jeopardize the appraisal final result.

By following the following tips and being aware of widespread pitfalls, veterans can successfully negotiate Vendor/Builder concessions to boost the worth of their residence buy whereas making certain compliance with VA mortgage pointers.

FAQs about Vendor/Builder Concessions in VA Loans

What are Vendor/Builder concessions in VA loans?

Vendor/Builder concessions are monetary contributions that the vendor or builder of a house can provide to the customer, which can be utilized to cowl numerous purchaser prices in a VA mortgage transaction.

These concessions embody paying off money owed, offering home equipment, or overlaying a part of the closing prices, capped at 4% of the mortgage quantity.

How do Vendor/Builder concessions profit veterans?

These concessions can considerably scale back veterans’ upfront prices when shopping for a house, permitting for extra monetary flexibility.

They’ll cowl non-allowable closing prices, provide upgrades to the property, and even assist repay present money owed, making residence shopping for extra accessible and inexpensive for veterans.

Can Vendor/Builder concessions cowl closing prices?

Sure, however not directly. Whereas the 4% cap is unique of the customer’s closing prices, sellers can nonetheless contribute to closing prices individually.

This implies the full worth of contributions from the vendor might exceed 4% if additionally they comply with pay for closing prices.

What cannot be coated by Vendor/Builder concessions?

Vendor/Builder concessions can’t be used for down fee, and there are limits on paying off money owed, judgments, or credit score balances that exceed the 4% cap.

They’re primarily for prices instantly useful to the customer exterior of closing prices.

Are there any restrictions on what the concessions can be utilized for?

Sure, the concessions have to be agreed upon and throughout the 4% cap of the mortgage quantity.

They can be utilized for numerous functions like home equipment, paying off credit score balances, and even paying for short-term housing if wanted, however they can’t be used for the down fee on the house.

How does the 4% cap on concessions evaluate to standard loans?

The 4% cap is restricted to VA loans and is usually extra beneficiant than concession limits on typical loans, which fluctuate based mostly on the down fee quantity and could be decrease.

This makes VA loans notably enticing for veterans.

What occurs if the concessions exceed the 4% restrict?

Suppose Vendor/Builder concessions exceed the 4% cap.

In that case, it might require a discount within the sale worth or a re-negotiation of the phrases to make sure compliance with VA mortgage pointers, as exceeding this restrict might influence mortgage approval.

Can Vendor/Builder concessions be used to repay the customer’s money owed?

Sure, one of many distinctive advantages of Vendor/Builder concessions in a VA mortgage is the flexibility to make use of these funds to repay the customer’s present money owed, which will help enhance the debt-to-income ratio and probably qualify for a greater mortgage charge.

How do I negotiate for Vendor/Builder concessions in my VA mortgage?

Negotiating for concessions includes understanding your wants as a purchaser and speaking them clearly to the vendor.

Working with an actual property agent or a lender with expertise with VA loans is useful and will help advocate in your pursuits throughout the negotiation.

Do Vendor/Builder concessions have an effect on the mortgage quantity?

No, the mortgage quantity relies on the house’s buy worth and the VA’s authorised quantity.

Nonetheless, Vendor/Builder concessions can have an effect on the general monetary elements of the transaction, similar to decreasing the out-of-pocket bills for the veteran purchaser.

The Backside Line

When buying a house, veterans who wish to maximize their VA advantages should perceive Vendor/Builder concessions.

These concessions can considerably scale back out-of-pocket bills, present monetary flexibility, and improve the general worth of the house buy.

Given the complexities and nuances of VA mortgage concessions, veterans are inspired to seek the advice of with mortgage professionals like our group at MakeFloridaYourHome.

We will help navigate the specifics of VA loans, making certain veterans take advantage of knowledgeable selections and totally leverage the benefits accessible to them by their service advantages.