Reward funds, which can be utilized for down funds and shutting prices, will be an effective way to reduce the burden of shopping for a house as a veteran.

This information supplies a complete overview of those matters, guaranteeing veterans have the knowledge to make knowledgeable choices about their residence buy and financing choices.

What’s a Reward Fund?

A present fund is a financial reward supplied by relations, associates, or different benefactors to help with the acquisition of a house.

These funds are notably priceless in VA loans since they can be utilized for closing prices, down funds, or different mortgage-related bills with out the expectation of compensation.

By lowering the burden on veteran homebuyers, homeownership turns into extra reasonably priced and accessible.

The reward fund differs from a mortgage as a result of it doesn’t require compensation; the giver doesn’t anticipate any return or compensation for the reward.

The approval and phrases of VA loans rely upon guaranteeing that reward funds are literally presents. To make the most of these funds successfully, veterans should adhere to VA tips and preserve correct documentation.

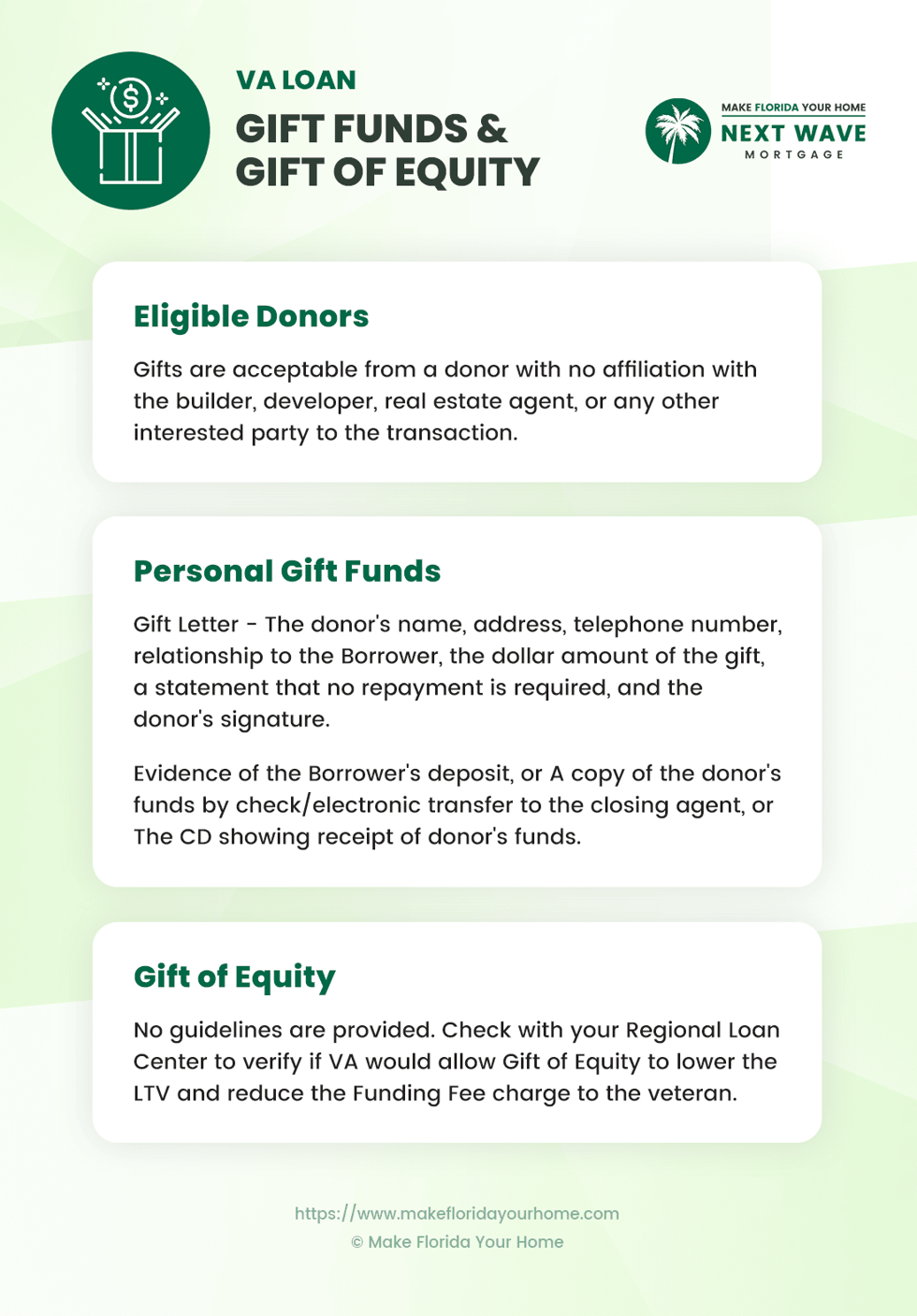

Eligibility of Reward Donors for VA Loans

Based on the VA Lenders Handbook, Chapter 4, 4-d, an eligible reward donor is outlined as any particular person who doesn’t have an affiliation with the builder, developer, actual property agent, or every other celebration to the transaction.

Because of this definition, relations, associates, and different beneficiant contributors will have the ability to contribute to the veteran’s residence buy with out having any involvement within the sale.

By requiring a real gesture, the VA ensures that the reward just isn’t getting used to affect the transaction or to demand compensation.

“Items are acceptable from a donor with no affiliation with the builder, developer, actual property agent, or every other celebration to the transaction,” as outlined within the Handbook.

This rule is designed to take care of the VA mortgage program’s integrity and shield the veteran homebuyer’s pursuits.

To forestall potential conflicts of curiosity or unethical preparations which may drawback veterans, the VA requires that donors don’t have any direct monetary or private curiosity within the sale.

Thus, the reward is targeted solely on aiding the veteran in changing into a house owner, reinforcing the dedication of the VA mortgage program to serve returning veterans.

Acceptable Reward Sources and Makes use of for VA Loans

Acceptable reward sources for VA loans aren’t explicitly restricted by the U.S. Division of Veterans Affairs so long as the donor doesn’t have an affiliation with the builder, developer, actual property agent, or every other celebration within the transaction.

Nonetheless, widespread sources of reward funds which are typically accepted embody:

-

Household Members: Mother and father, siblings, grandparents, youngsters, aunts, and uncles can present reward funds. Prolonged relations might also be thought of acceptable donors.

-

Fiancés or Home Companions: People with a longstanding relationship with the borrower that may be simply documented.

-

Shut Buddies: Buddies who’ve a clearly outlined and documented relationship with the borrower, indicating a big private connection that might logically assist the reward.

-

Employers or Labor Unions: Organizations or entities the borrower is related to, akin to their place of employment or a labor union member.

-

Charitable Organizations: Non-profit organizations or neighborhood teams that help veterans or homebuyers.

- Authorities Companies or Public Entities: Packages supply veterans or first-time homebuyers homeownership help.

Underneath VA mortgage tips, an appropriate reward is a voluntary switch of funds from the donor to the veteran borrower, with no expectation of compensation.

These presents function a significant useful resource for veterans, aiding them in overlaying the monetary necessities of buying a house.

The VA’s strategy to reward funds is designed to make sure these contributions are real presents, thus supporting veterans of their path to homeownership.

Items below VA mortgage tips can be utilized for numerous functions, making them a flexible instrument for veterans’ home-buying course of.

Particularly, acceptable presents embody:

-

Down Fee Help: Items can be utilized to make the down cost on a house, making it simpler for veterans to safe financing without having private financial savings.

-

Closing Prices: Items can cowl closing prices, that are numerous charges for finalizing the mortgage. This could embody appraisal charges, title insurance coverage, and extra.

-

Paying Off Money owed: In some instances, presents can be utilized to repay money owed to enhance the veteran’s debt-to-income ratio, a key consider mortgage qualification.

- Prepaids: These are upfront prices paid at closing, together with house owner’s insurance coverage, property taxes, and preliminary escrow deposits.

The flexibleness of utilizing presents for these bills permits veterans to leverage the generosity of their community, thereby lowering the monetary burden of buying a house.

This adaptability highlights the VA mortgage program’s dedication to offering veterans with accessible pathways to homeownership, emphasizing this system’s objective to honor those that have served by making the dream of proudly owning a house extra attainable.

Tips for Private Reward Funds

The VA Lenders Handbook supplies a foundational overview of reward funding acceptance throughout the VA mortgage course of.

Nonetheless, it doesn’t delve into intensive further steerage relating to private reward funds. Private presents ought to adhere to a couple easy however essential necessities as a result of absence of detailed directives.

All events concerned are protected by these circumstances to make sure that reward funds are certainly real presents and aren’t anticipated to be repaid, sustaining the integrity of the mortgage course of.

-

Donor Eligibility: Items have to be from people with out affiliation to the transaction, together with builders, builders, actual property brokers, or every other events.

-

Reward Letter: A letter from the donor is required, together with their title, handle, phone quantity, relationship to the borrower, the reward quantity, a press release that no compensation is anticipated, and the donor’s signature.

-

Proof of Switch: Documentation exhibiting funds switch from the donor to the borrower or closing agent, akin to a financial institution assertion or transaction receipt, is critical.

- No Reimbursement: It have to be clear that the reward just isn’t a mortgage and that no compensation is anticipated or required.

The essential necessities for private presents are essential for donors and recipients to know. The VA emphasizes that reward funds have to be sourced from people with out affiliation to the true property transaction, excluding builders, builders, actual property brokers, or any associated events.

This guideline is designed to forestall conflicts of curiosity and make sure the reward’s authenticity, supporting the veteran borrower’s monetary wants with out compromising the transaction’s impartiality.

Documentation for Private Reward Funds

Particular documentation is required to just accept and make the most of private reward funds throughout the VA mortgage course of. This documentation verifies the reward’s legitimacy and the donor’s intentions, aligning with VA tips.

The required paperwork embody:

Reward Letter Necessities

A complete reward letter should accompany any private reward funds. This letter must comprise a number of key items of data to satisfy VA requirements:

-

Donor’s Title, Deal with, and Phone Quantity: These particulars assist establish the donor and supply contact data for verification functions.

-

Relationship to the Borrower: Clarifying the connection ensures that the donor has no prohibited curiosity in the true property transaction.

-

Greenback Quantity of the Reward: Specifies the quantity given to the borrower.

-

Assertion of No Reimbursement Required: This declaration is essential, because it confirms the reward doesn’t must be repaid, distinguishing it from a mortgage.

- Donor’s Signature: The signature verifies the donor’s acknowledgment and settlement to the phrases outlined within the reward letter.

Proof of the Borrower’s Deposit

Along with the reward letter, proof of the reward’s switch and receipt is required:

This documentation is critical for correctly dealing with private reward funds throughout the VA mortgage framework. It ensures transparency, compliance, and the sleek development of the mortgage utility course of, finally aiding veterans in securing financing for his or her residence purchases.

What’s A Reward of Fairness, and How Can They Assist Veterans?

A present of fairness includes the sale of a property beneath its market worth, the place the distinction between the sale worth and the market worth is taken into account a present of fairness from the vendor to the customer. This idea is especially related in VA loans when a member of the family sells the property to a veteran.

The fairness, or the property’s worth not lined by the mortgage, successfully contributes to the veteran’s residence fairness. This could considerably cut back the Mortgage-to-Worth (LTV) ratio, which is the comparability between the quantity of the mortgage and the worth of the house.

A decrease LTV ratio can profit the borrower by doubtlessly lowering the VA funding price, a one-time price paid to the Division of Veterans Affairs to assist assist the mortgage program.

Regardless of the potential advantages of a present of fairness, akin to lowering the amount of money a purchaser wants at closing and presumably reducing the funding price, the VA Lenders Handbook doesn’t present particular tips on presents of fairness.

The absence of detailed directions signifies that accepting and utilizing a present of fairness can rely upon numerous elements, together with lender insurance policies and the interpretation of VA mortgage necessities.

Given this lack of steerage from the VA, it is essential for veterans focused on utilizing a present of fairness to seek the advice of with MakeFloridaYourHome or one other trusted lender.

We will supply personalised recommendation and make clear whether or not a present of fairness is allowable in your state of affairs. We will additionally present data on required documentation and any further steps to incorporate a present of fairness as a part of a VA mortgage transaction.

In abstract, whereas a present of fairness can supply substantial monetary advantages to veterans buying a house from a member of the family, navigating the method requires a cautious strategy.

By reaching out to MakeFloridaYourHome, veterans can guarantee they meet all necessities and maximize the benefits out there by the VA mortgage program.

Incessantly Requested Questions About Reward Funds for VA Loans

Who can present reward funds in response to VA mortgage tips?

Items for VA loans will be supplied by anybody who doesn’t have an affiliation with the builder, developer, actual property agent, or every other celebration within the transaction. This ensures the integrity of the reward, confirming the sale of the property doesn’t affect it.

What can reward funds be used for in a VA mortgage?

A VA mortgage can use reward funds for down cost, closing prices, or different loan-related bills. This flexibility helps veterans and navy personnel handle buying a house’s funds.

Is there a restrict to the quantity of reward funds one can obtain?

The VA doesn’t restrict the reward funds a borrower can obtain. Nonetheless, lenders could have their very own tips, so it is important to seek the advice of along with your lender.

Do reward funds must be repaid?

No, reward funds don’t must be repaid. The donor should present a present letter stating that the funds are a present and no compensation is anticipated.

What documentation is required for reward funds in a VA mortgage?

For reward funds, the borrower should present a present letter from the donor that features the donor’s title, handle, phone quantity, relationship to the borrower, the quantity of the reward, a press release that no compensation is required, and the donor’s signature.

Can reward funds be used for the complete down cost on a VA mortgage?

Sure, reward funds can cowl the complete down cost, supplied the funds meet VA and lender tips and are correctly documented.

What occurs if the donor of the reward funds is affiliated with the true property transaction?

Items from donors affiliated with the true property transaction (e.g., builder, developer, actual property agent) are unacceptable below VA tips to forestall conflicts of curiosity.

How do reward funds have an effect on the loan-to-value (LTV) ratio?

Reward funds used in the direction of the down cost can decrease the loan-to-value ratio, doubtlessly enhancing mortgage phrases and lowering the funding price.

Can a member of the family present reward funds?

Sure, relations can present reward funds for a VA mortgage so long as they don’t have any affiliation with the true property transaction.

Are there any particular tips for presents of fairness in VA loans?

The VA Lenders Handbook doesn’t present particular tips for presents of fairness. Debtors are suggested to test with their Regional Mortgage Heart for eligibility and documentation necessities relating to presents of fairness.

Backside Line

Using reward funds throughout the VA mortgage course of presents veterans and lively navy personnel a big benefit in reaching homeownership.

These funds, which might cowl down funds, closing prices, and different loan-related bills, present monetary flexibility and assist. The secret is guaranteeing that reward funds come from eligible donors and are correctly documented in response to VA tips.

By leveraging reward funds properly, veterans can navigate the home-buying course of extra successfully, making the dream of proudly owning a house extra accessible and reasonably priced.